Many Bored Ape NFTs Mortgage Is At Risk of Liquidation

NFT lending platform BendDAO has mortgaged nearly 3% of its entire Bored Ape collection and many other NFTs have now entered the “danger zone” of liquidation.

The problem is happening at BendDAO, a lending service that allows users to borrow Ethereum (ETH) as collateral for their NFT. Typically, customers can borrow a loan equal to 30% to 40% of the floor price of the NFT collection.

The price floor has fallen in recent months, to the point where 45 of the 272 Bored Apes with a BendDAO loan attached to them are now in a state of jeopardy as an NFT used as collateral is about to begin. auctioned. In other words, $5.3 million worth of Bored Apes is at risk of liquidation.

The mass liquidation event could also have implications for other NFT lending services, which have gained prominence over the past year as the NFT industry boomed. Additionally, Bored Apes is one of the most prominent, if not the most important, NFT collections, so a cascade liquidation in that space could have major consequences for the NFT market, not just Bored Apes.

DoubleQ the founder of Web3 launchpad DoubleStudio, claims on Twitter that this BAYC loan liquidation has the potential to nuke the entire NFT Market.

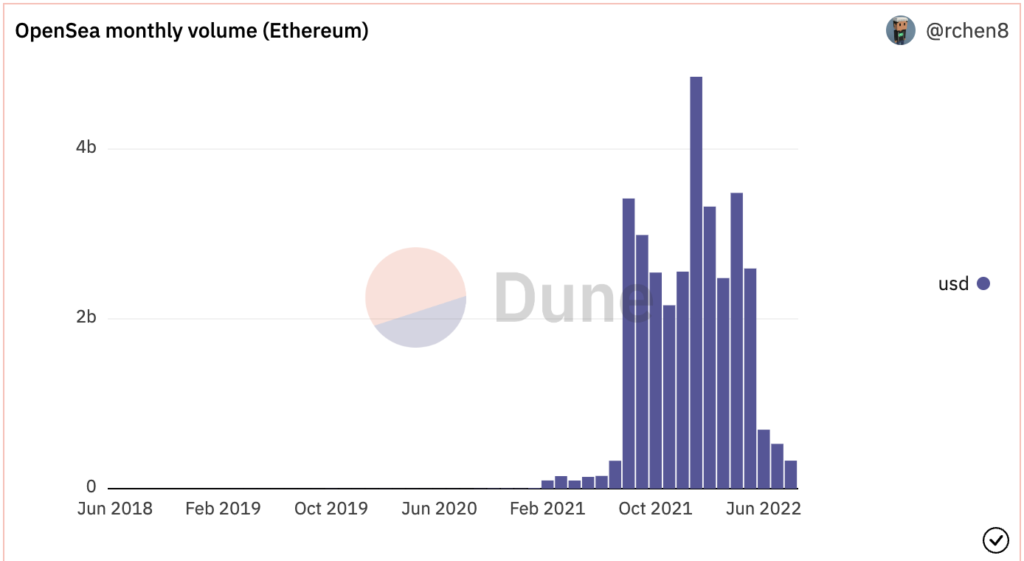

Opensea NFT volume is currently at the lowest point it has ever been in the last 12 months, meaning there will not be enough volume to save these NFTs from liquidations. Borrowers will have 48 hours to repay the loans or their collateral will be liquidated.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Foxy

CoinCu News